Insight #1

Money isn’t just a number

Nothing like the portrait of Benjamin Franklin to be sure to hold 100 dollars in your hands. But some alternative and dematerialized currencies tend to make this kind of reference disappear; which makes budget control more and more difficult for people.

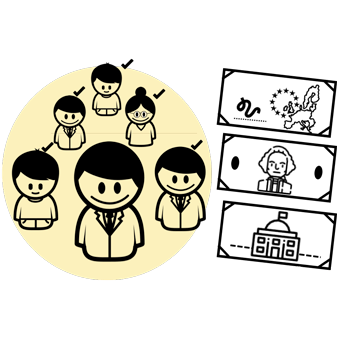

1. Money is first and foremost a matter of belief

A 100 euro note is only a piece of paper. Then, why do we assign value to it? Because money is before all a collective belief. For a piece of paper to be accepted as currency, everyone must believe that it is indeed carrying money. The symbols - monuments, flags, portraits, maps - remind us that, in a given territory, everyone agrees to act as if it were money.

2. But some currencies raise doubt

When they pay by credit card, some people do not realize how much money they spend: they do not physically see it moving away from them. The same logic applies to luncheon vouchers: vegetables and forks in the background are a good reminder of what they are accepted for, but these symbols are not enough to make them count as money, to the point that the estimate of the budget can be distorted. Deprived of the symbols by which they intuitively recognize money, individuals spend it without being aware of it. And for a good reason, as they can literally not believe it.

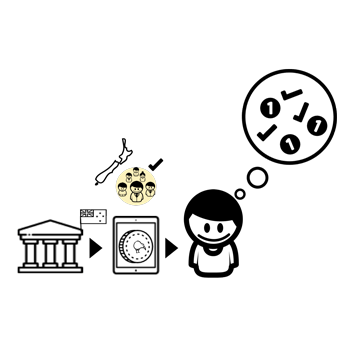

3. Applications to regain control

In its application designed to teach children how to manage their money, the New Zealand bank ASB reinstated the face of the coins. When a dollar is used, the bird that symbolizes New Zealand - the kiwi - is made visible. The golden color of the coin evokes its financial value. Even dematerialized, the currency is recognizable: all the symbols attest that it is indeed money.

4. Restore confidence to control the money

Some actors forget that individuals need to be sure that their piece of paper or screen is actually carrying money. Reinstating the usual symbols of money in the new supports, or even inventing a new symbolic of collectively accepted money, are two opportunities to give individuals the certainty of controlling their money. And what if we help them to have this certainty?

L'étude

#GérerSonArgent

Currencies in practice

The banking sector believes that individuals use different currencies interchangeably and that they use them only to pay for purchases. In reality, individuals do not use all currencies in the same way, even though these currencies have exactly the same financial value. These various practices deserve to be understood to be better accompanied.

Découvrir l'étude