Insight #1

The unsustainable liquidity of money

Money has the advantage of allowing the exchange of things that have absolutely nothing to do with each other. However, this liquidity is also an obstacle to its control. As individuals try to regain control of money, banks maintain its liquidity.

1. The liquidity of money is an obstacle to its control

The liquidity of the money makes it the perfect intermediary of the exchanges but it makes its control difficult. It requires constant efforts from individuals: an accounting discipline, constant knowledge of the money they have, and great self-control so that money does not slip away.

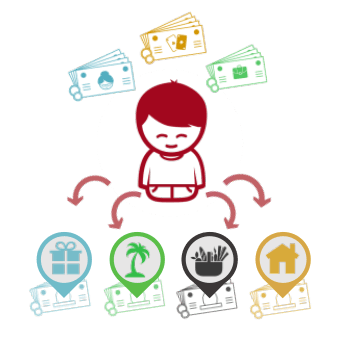

2. To control money, people charge it with meaning

This meaning comes as much from the origin of the money (which conditions its use) as from its destination (which gives it a use). The origin and the destination of the money slow down its circulation, constraining it to certain expenses. Thus, people divide the money into different sealed pots that some even put in separate boxes: that of shopping, holidays, gifts or rent.

3. But the bank maintains the liquidity of money

Because its role is to facilitate trade, the bank is structured around the liquidity of money. By maintaining this liquidity, the bank destroys the meaning that individuals have attributed to it. The various instruments of the bank (banking products, means of payment) are only intended to make money circulate more easily. For banks, the money from shopping or vacation is completely interchangeable.

4. The bank and money control

It is by slowing the liquidity of money that individuals manage to control it. What if the bank helped them to control the money?

L'étude

#GérerSonArgent

Managing money: constraints and risks influencing people’s practices

Banks and institutions share a certain idea of what money is and what people have to do with it. These preconceptions structure their banking products upstream as well as their service offer to individuals. Yet, the relationship of people to money is not obvious and deserves to be investigated. Are the perception of money and its actual use in line with the assumptions of banks? These lessons come from our report on the uses of money.

Découvrir l'étude