Insight #1

To insure against risk is risking insurance

The strength of insurance is to quantify a risk and set a price. It allows individuals to cover what is unpredictable to them. But insurance does not cover everything. When a disaster occurs, it is sometimes not in the individuals’ interest to use it.

1. Insurance limits its coverage

Although it suggests to individuals that it protects them, insurance does not cover everything and requires them to bear part of the risk. While I am covered, the insurance imposes me a deductible and I must ensure that I did everything that I could to avoid the risk.

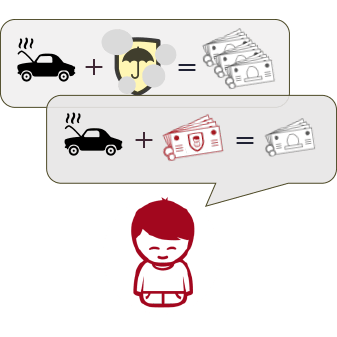

2. In the event of a damage, insurance may have adverse consequences

Using insurance can be less advantageous than solving the problem yourself. In the event of a disaster, it is sometimes in my interest to fund the repairs myself rather than using my insurance, as it might increase its rates.

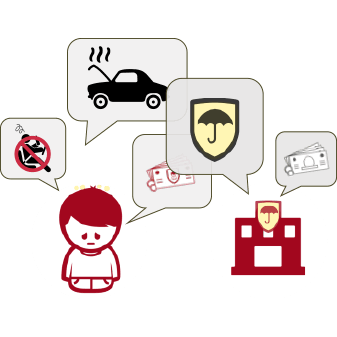

3. Insurance does not encourage individuals to use complementary practices and does not help them to evaluate their interests

Insurance does not encourage individuals to supplement their protection with savings. When a disaster occurs it does not help them to act in their best interest: to privilege other means of covering themselves rather than risking the double sanction of the sinister and the penalty.

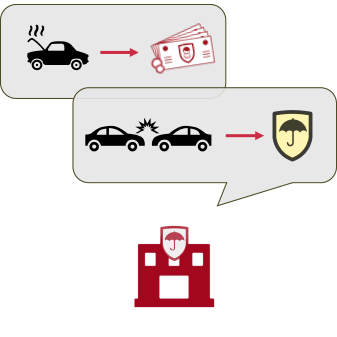

4. And what if insurance helped individuals act in their own interest

What if insurance helped individuals to mobilize the most appropriate protection to the disaster experienced, rather than imposing their own functioning?

L'étude

#GérerSonArgent

Risks perception and protection

The insurance sector has a fixed and absolute vision of the risks and the ways people must protect themselves. These assumptions shape insurance products and the relationship that insurance has with individuals. Yet, the ways people protect themselves are multiple and deserve to be studied. Are risk perception and protection practices in line with insurance assumptions? These lessons come from our investigation of risk perception and protection.

Découvrir l'étude