Insight #2

Savings is the first insurance of individuals

The majority of risks experienced by individuals are small risks, not covered by insurance. To deal with theses risks, they cover them with their savings.

1. Individuals take responsibility for part of their risks

On a daily basis, individuals cover many risks without using their insurance. Breakdown of their appliances or unforeseen expenses: they identify a certain number of risks that they take on directly.

2. Money is a way to cover these risks

Individuals cover these risks of everyday life by always keeping a little money aside which serves them especially for that. This savings are a safety cushion that allows them to absorb the little hazards of everyday life.

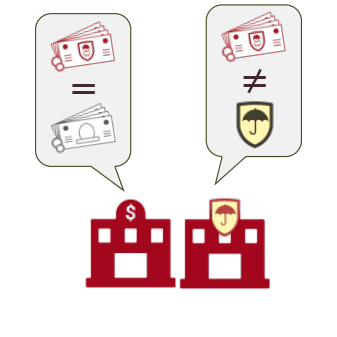

3. But insurance and banks do not consider this money as a protection

Insurance and banks see this money as an investment, while for individuals savings and insurance are two complementary ways to manage risk.

4. Money and insurance

To cover risks, individuals combine savings and insurance. And what if banks and insurance companies finally designed products that combine different protection practices?

L'étude

#GérerSonArgent

Risks perception and protection

The insurance sector has a fixed and absolute vision of the risks and the ways people must protect themselves. These assumptions shape insurance products and the relationship that insurance has with individuals. Yet, the ways people protect themselves are multiple and deserve to be studied. Are risk perception and protection practices in line with insurance assumptions? These lessons come from our investigation of risk perception and protection.

Découvrir l'étude